Our risks

Annual report JSOC Bashneft 2013

30

Our risks

Annual report JSOC Bashneft 2013

31

ABOUT

THE COMPANY

OPERATING RESULTS

CORPORATE GOVERNANCE

APPENDICES

INFORMATION FOR

SHAREHOLDERS AND INVESTORS

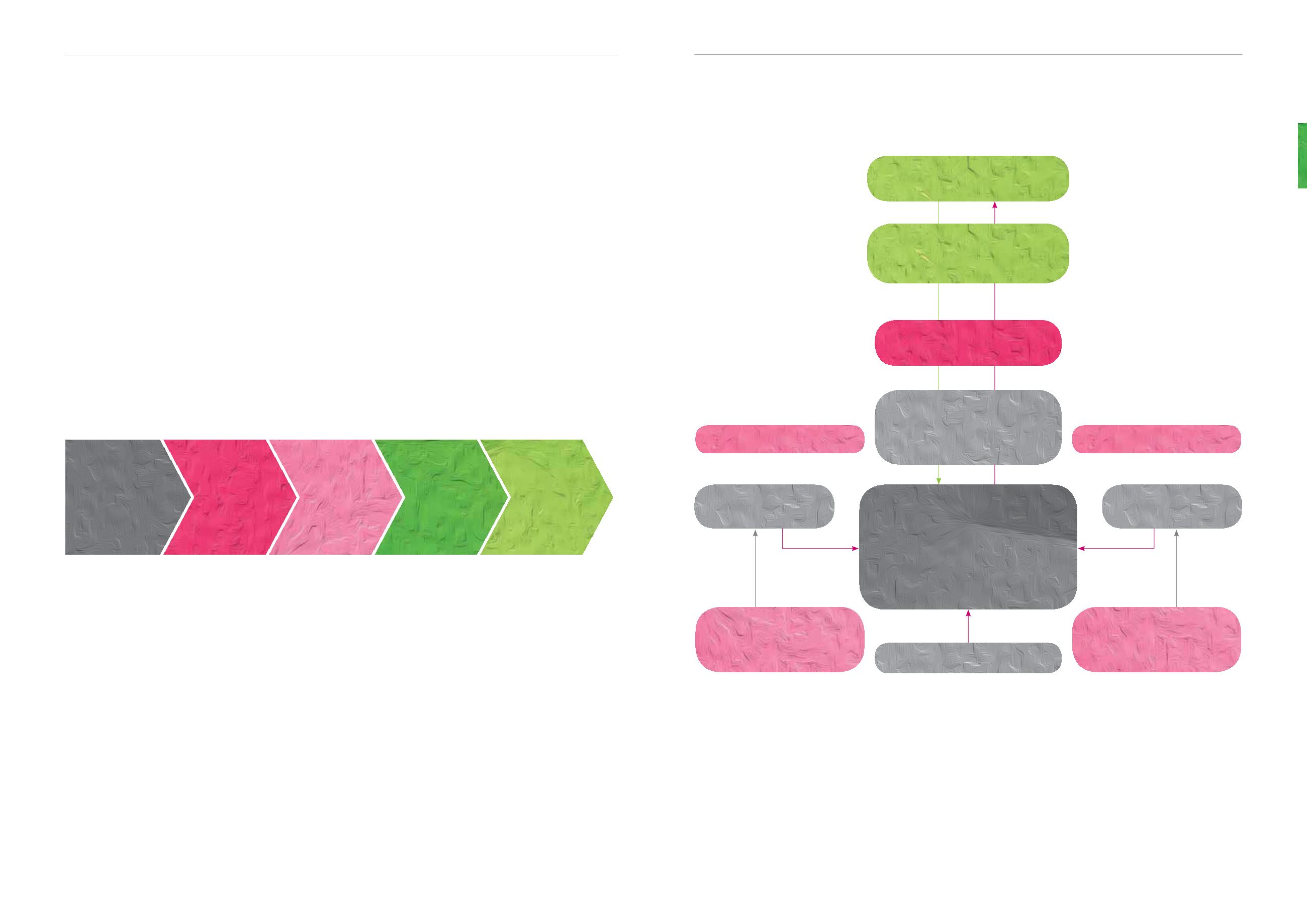

Risk management – organizational structure

Bashneft systematically assesses possible risk events when implementing current investment projects and conducting opera-

tions. The impact of potential events is assessed from two points of view: probability and the degree of negative impact (the

amount of damage).

The outcome of such assessments is the basis for the ranking of risks from the standpoint of their potential impact upon the

activities of the Company. Risks are divided into three levels of managerial decision-making: the ‘Management Board’, the ‘Risk

Committee’, and ‘Line Management’.

The objective of risks ranking and prioritisation is the identification of the most crucial risks and prioritisation of risk manage-

ment actions for the period under review.

Board of Directors/Management

Approval of risk management strategy

Board Committee on Finance, Budget

and Risk Management

Carries out Risk Control procedures

Accountability

Accountability

Risk Passport

Information

Information

Risk Passport

Accountability

Risk Management Committee

Approves Risk Register and Mitigation

Plans

Risk Management Centre

(reports to VP for economics and finance)

· Risk management database

· Corporate risk register

· Risk impact appraisal and modelling

· Preparation of risk management report

At-risk parties

(JSOC Bashneft)

At-risk parties

(JSOC Bashneft)

Management

Business management risks

· Responsible for certain risk

management activities

· Branches, subsidiaries and

affiliates

· Responsible for certain risk

management activities

· Branches, subsidiaries and

affiliates

Operational risks

Managers of major projects

Our risks

How we manage risk

The Group’s operations may face external and internal opera-

tional risks. Bashneft takes all possible measures for monitor-

ing and preventing risk, and this is one of the most important

tasks for the Company.

We perform regular monitoring of potential risk events and

take measures to prevent their materialisation. In instances

when such materialisation is inevitable, we take all necessary

action in order to mitigate the potential negative repercussions.

The contemporary oil and gas industry Bashneft is a part of,

is affected by a variety of different factors. In order to correctly

assess and respond to their cumulative impact upon its activi-

ties, the Group needs a well thought through and efficiently ap-

plied risk management system.

In order to improve the efficiency of the risk management pro-

cesses, we apply the Integrated Risk Management System. The

System was developed and put into practice in 2010, with the

engagement of a “Big Four” consulting firm, based upon the

commonly accepted conceptual models of risk management,

put together by the Committee of Sponsoring Organisations

of the Treadway Commission (COSO ERM) and summarised

in the “Enterprise Risk Management – Integrated Framework”

document.

Bashneft risk management process – key stages

The Company’s goals, objectives and concepts in the field of risk

management are delineated in the Corporate Policy titled “Inte-

grated Risk Management”.

The integrated risk management action takes place at each level

of the Company’s management, and is an integral part of the cor-

poratemanagement. The current riskmanagement systemhelps

the Company strive to achieve specific strategic goals with the

cumulative level of risks that is acceptable to its stockholders and

the Management.

The Integrated Risk Management System infers quarterly defini-

tion and implementation of steps and measures in order to:

· Identify risks relevant to JSOC Bashneft, and review them

in a systemic manner;

· Assign ownership of the risks and accountability for their man-

agement;

· Put together action plans in order to respond to the existing

risks; control the execution of the plans;

· Monitor the risks along with the efficiency of their management;

· Accumulate expertise in the field of integrated risk manage-

ment;

· Submit reports upon the management of risks.

When managing its risks, the Company applies an integrated ap-

proach: the entire range of current risks is taken into account,

along with specific features of the Group’s organisational and

geographical structure. The JSOC Bashneft Risk Management

and Insurance Department coordinates the risk management

activities of the Group’s units and divisions, and ensures due ac-

count of mutual impact of risks owned by different Group units.

The Department also maintains a unified information channel,

in order to keep the Executive Managementinformed on the entire

range of the Group’s risks, in order to assure the completeness,

quality and comparability of information provided for managerial

decision making.

Risk

identification

Risk

reporting

Risk

management

actions definition

Risk control

and monitoring

of risk

management

processes

Risk

assessment